Friday, September 26, 2008

Friday, February 22, 2008

NO SIGNS OF STABILIZATION

a relatively low real federal funds rate now appeared appropriate for a time

to counter the factors that were restraining economic growth, including the

slide in housing activity and prices, the tightening of credit availability, and

the drop in equity prices. Members judged that a 50 basis point reduction in the

federal funds rate, together with the Committee’s previous policy actions, would

bring the real short-term rate to a level that was likely to help the economy

expand at a moderate pace over time. Still, with no signs of stabilization in

the housing sector and with financial conditions not yet stabilized, the

Committee agreed that downside risks to growth would remain even after this

action. Members were also mindful of the need for policy to promote price

stability, and some noted that, when prospects for growth had improved, a

reversal of a portion of the recent easing actions, possibly even a rapid

reversal, might be appropriate.

To read more, CLICK HERE!

Saturday, February 9, 2008

Manassas - January 2008 Trend Report

Residential Homes trended DOWN by 26.9% (January Year-to-Year)

Original Price: $287,960

Sales Price: $242,567 (84.2% of Original Price)

Average Days on Market: 129

Number of Homes Sold: 89

Currently Active Listings:

Average List Price: $245,153

Average Days on Market: 129

Total Listed: 1812

It is important to know the path the market is currently on. Sellers need to lead the market not follow. Continually lagging behind the trend will lead to higher days on the market and lower "walkaway" sales prices.

Friday, February 8, 2008

Gainesville - January 2008 Trend Report

Sales Price: $414,708 (89.3% of Original Price)

Average Days on Market: 101

Number of Homes Sold: 31

Average List Price: $486,568

Average Days on Market: 178

Total Listed: 358

Haymarket - January 2008 Trend Report

Original Price: $511,932

Sales Price: $449,896 (88.0% of Original Price)

Average Days on Market: 168

Number of Homes Sold: 42

Average List Price: $604,866

Average Days on Market: 261

Total Listed: 302

Wednesday, February 6, 2008

The Price of Ownership

A useful way to look at the total cost of housing is to evaluate the monthly cost of ownership. An ownership cost is any expenditure required for the possession of property. A working definition is important because there are many hidden or forgotten costs people overlook. These costs are borne by owners and not by renters. There are 7 costs to owning a house. Although some of these costs are not paid on a monthly basis, they can be evaluated on a monthly basis with simple math. These costs are:

- Mortgage Payment

- Property Taxes

- Homeowners Insurance

- Private Mortgage Insurance

- Special Taxes and Levies

- Homeowners Association Dues or Fees

- Maintenance and Replacement Reserves

Mortgage Payment

The mortgage payment is the first and most obvious payment because it is the largest. It is also an area where people take risks to reduce the cost of housing. It was the manipulation of mortgage payments that was the focus of the lending industry “innovation” that inflated the housing bubble. The relationship between payment and loan amount is the most important determinant of housing prices. This relationship changes with loan terms such as the interest rate, but it is also strongly influenced by the type of amortization, if any. Amortizing loans, loans that require principal repayment in each monthly payment, finance the smallest amount. Interest-only loan terms finance a larger amount than amortizing loans because none of the payment is going toward principal. Negatively amortizing loans finance the largest amount because the monthly payment does not cover the actual interest expense.

Property Taxes

Property taxes have long been a source of local government tax revenues. Real property cannot be moved out of a government’s jurisdiction, and values can be estimated by an appraisal, so it is a convenient item to tax. In most states, local governments add up the cost of running the government and divide by the total property value in the jurisdiction to establish a millage tax rate. Often the lender will compel the borrower to include extra money in the monthly payment to cover property taxes, homeowners insurance, and private mortgage insurance, and these bills will be paid by the lender when they come due. If these payments are not escrowed by the lender, then the borrower will need to make these payments. The total yearly property tax bill can be divided by 12 to obtain the monthly cost.

Homeowners Insurance

Homeowners insurance is almost always required by a lender to insure the collateral for the loan. Even if there is no lender involved, it is always a good idea to carry homeowners insurance. The risk of loss from damage to the house can be a financial catastrophe without the proper insurance. A standard policy insures the home itself and the things you keep in it. Homeowners insurance is a package policy. This means that it covers both damage to your property and your liability or legal responsibility for any injuries and property damage you or members of your family cause to other people. This includes damage caused by household pets. Damage caused by most disasters is covered but there are exceptions. The most significant are damage caused by floods, earthquakes and poor maintenance. You must buy two separate policies for flood and earthquake coverage. Maintenance-related problems are the homeowners’ responsibility.

Private Mortgage Insurance

Mortgages against real property take priority on a first recorded, first paid basis. This is known as their lien position. This becomes very important in instances of foreclosure. The 1st mortgage holders gets paid in full before the second mortgage holder gets paid and so on through the chain of mortgages on a property. In a foreclosure situation, subordinate loans are often completely wiped out, and if the loss is great enough, the first mortgage may be imperiled. Because of this fact, if the purchase money mortgage (1st lien position) exceeds 80% of the value of the home, the lender will require the borrower to purchase an insurance policy to protect the lender in event of loss. This policy is of no use or benefit to the borrower as it insures the lender against loss. It is simply an added cost of ownership. Many of the purchase transactions during the bubble rally had an 80% purchase money mortgage and a “piggy back” loan of up to 20% to cover the remaining cost. These loan pairs are often referred to as 80/20 loans, and they were used primarily to avoid private mortgage insurance. There were very common during the bubble.

Special Taxes and Levies

Several areas have special taxing districts that increase the tax burden beyond the normal property tax bill. Many states have provisions which allow supplemental property tax situations. These provisions may be established to obtain public financing through the sale of bonds for the purpose of financing certain public improvements and services. These services may include streets, water, sewage and drainage, electricity, infrastructure, schools, parks and police protection to newly developing areas. The taxes paid are used to make the payments of principal and interest on the bonds.

Homeowner Association Dues and Fees

Many modern planned communities have homeowners associations formed to maintain privately owned facilities held for the exclusive use of community residents. These HOAs bill the owners monthly to provide these services. They have foreclosure powers if the bills are not paid. It is given the authority to enforce the covenants, conditions, and restrictions (CC&Rs) and to manage the common amenities of the development. It allows the developer to legally exit responsibility of the community typically by transferring ownership of the association to the homeowners after selling off a predetermined number of lots. Most homeowners’ associations are non-profit corporations, and are subject to state statutes that govern non-profit corporations and homeowners’ associations.

Maintenance and Replacement Reserves

An often overlooked cost of ownership is the cost of routine maintenance and the funding of reserves for major repairs. For example, a composite shingle roof must be replaced every 20-25 years. It may take $100 a month set aside for 20 years to fund this replacement cost. Also, condominium associations often levy special assessments to undertake required work for which the reserves are insufficient. In the real world, most people do not set aside money for these items. Most will attempt to obtain a Home Equity Line of Credit (HELOC) to fund the repairs when they are necessary. Of course this assumes a property has appreciated and such financing will be made available.

Tax Savings

There are two other variables people often consider when evaluating the cost of ownership that is not included in the prior list: income tax savings and lost downpayment interest. When a borrower takes out a home loan, the interest is tax deductible up to a certain amount. For borrowers in the highest marginal tax bracket, the savings can be significant, and this can make a dramatic difference in the true cost of ownership. However, this benefit diminishes over time as the loan is paid off and the interest decreases. Plus, contrary to popular belief, it is never good financial planning to spend $100 to save $25 in taxes. Also, these benefits are almost universally overestimated by people considering a home purchase. A renter considering home ownership will need to remember they will be giving up the standard deduction when they itemize to obtain the Home Mortgage Interest Deduction (HMID). A “married filing jointly” taxpayer will forgo a $10,700 deduction in 2007. This reduces the net impact of the HMID. Anecdotally, even those in the highest tax brackets usually do not get more than a 25% tax savings.

Hidden Savings

This is the forgotten benefit of a conventionally amortizing loan: forced savings. Most people are not good at saving. The government recognized this years ago when they started taking money out of peoples salaries to pay income taxes because they knew people would not do it on their own. People who become homeowners during their lifetimes often have the equity in their home as their only source of retirement savings other than social security. To accurately calculate the cost of ownership, this hidden savings amount needs to be deducted from the total cost of ownership because this money will generally come back to the borrower at the time of sale. Since taxpayers in the United States get a capital gains exemption up to $250,000, this savings amount does not need to be adjusted for taxes.

Lost Downpayment Interest

Unless 100% financing is utilized, a cash downpayment will generally be withdrawn from an interest bearing account to purchase a house. The monthly interest that would have accrued if the downpayment money was still in the bank is a cost of ownership. This is perhaps the most overlooked ownership cost. For instance, if you are putting 20% down on a $500,000 property, you will be taking $100,000 from a bank account where it would have earned 5% in 2007. This $5,000 in interest comes to $417 in lost interest the moment this money gets tied up in real property. If someone chooses to rent rather than buy, they would earn this interest income. Of course, this earned income is also taxed, so 75% of this number is the net opportunity cost of a downpayment.

To establish the cost of ownership, each of these costs, if applicable, must be quantified. When the total monthly cost of ownership is equal to the rental rate, the market is considered to be at fair value for owner-occupants. In fact, this is the equilibrium in most real estate markets across the nation. In a strange way, the bubble did not upset this equilibrium. The use of negative amortization loans with artificially low teaser rates allowed borrowers to obtain double the loan amount with the same monthly payment: double the loan; double the purchase price. This is how prices were bid up so high so fast without a commensurate increase in wages. The elimination of these loans is also the reason prices collapse.

Ownership Cost Math

Below is a typical cost of ownership for a $500,000 Irvine property:

$500,000 Purchase Price

$100,000 Downpayment @20%

$400,000 Mortgage @ 80%

$2,528.27 Mortgage Payment @ 6.5%

$416.67 Property Taxes @ 1%

$104.17 Homeowners Insurance @ 0.25%

$104.17 Special Taxes and Levies @ 0.25%

$100.00 Homeowners Associate Dues or Fees @ $100

$625.00 Maintenance and Replacement Reserves @1.5%_________________________________________________________________________

$3,878.27 Monthly Cash Cost

………………$2,166.67 Interest on First Payment$(567.71) Tax Savings @ 25% of mortgage interest and property taxes

$(361.61) Equity hidden in payment

$312.50 Lost Downpayment Income @ 5% of Downpayment _________________________________________________________________________

$3,261 Total Cost of Ownership

Notes:

- The mortgage payment assumes a 30-year fixed-rate conventionally amortized mortgage at 6.5% interest.

- The property taxes are set at the 1%.

- The homeowners insurance is estimated at one-quarter of one percent per year.

- Private Mortgage Insurance is estimated at one-half of one percent per year. It is not included in the calculation above because this example utilized 80% financing. If the financing amount required PMI, the costs would have been over $200 a month higher.

- Special Taxes or Levies are estimated at one-quarter of one percent per year.

- HOA dues are estimated at $100: some are lower, and some are much higher.

- Maintenance and replacement reserves are estimated at 1.5%. This may be the most contentious estimate of the group because most people assume they will simply borrow their way around these costs when they are incurred. This certainly has been the pattern during the bubble years when credit was free flowing. This method of home improvement and maintenance may be significantly more difficult as the credit crunch and declining values make financing much more difficult to obtain. In any case, these costs are real, and failing to acknowledge them denies the realities of home ownership.

- The sum of the above costs are the monthly cash costs of ownership. A homeowner may not write a check for each of these costs every month, but the costs are still incurred, and renters do not pay them.

- The tax savings are based on the maximum interest payment at the beginning of a loan amortization schedule. This tax savings will decline each month as the mortgage is paid off. Contrary to popular belief, this is not a bad thing. Also, the property taxes are also deductable, but special taxes or levies are not fully deductible (even though most people mistakenly deduct it.)

- The opportunity cost of lost interest assumes a 5% interest rate on the downpayment reduced by 25% for taxes on this earned income.

So there you have it. The actual cost of ownership on a typical $500,000 property would be approximately $3,250 per month. Some will be higher and some will be lower, but the calculation above, when adjusted for the specific property details being examined, will yield the cost of property ownership.

Gross Rent Multiplier

So what general relationships can be inferred from the ownership cost breakdown provided above? First, notice the relationship between monthly cost and price. This property is worth 154 times the monthly cost when you fully examine the cost of ownership. This is the basis for the Gross Rent Multiplier (GRM). The GRM is a convenient way to evaluate whether or not a rental rate will cover the monthly cost of a particular property. It was developed by landlords seeking a method to quickly evaluate the purchase price of a property to see if it would be a profitable investment. When performing such an evaluation, a cashflow investor will typically look for a GRM near 100 to find a property with positive cashflow. This method can also be easily adapted to calculate the breakeven point where an owner/occupant would break even compared to renting. As you can see, when you consider the full cost of ownership — including those costs often ignored — the gross rent multiplier is lower than most think. The GRM of 154 is very close to the 160 I have been using in my posts here. The Gross rent multiplier is a convenient measure of value because it spares you the brain damage of performing the above, detailed calculation for every property you wish to evaluate.

Renting Versus Owning

Renting versus owning is both an intellectual, financial decision and an emotional one. The financial decision is first and foremost an analysis of the comparative cost of renting versus owning. The cost of a rental can be determined fairly easily as there are usually a number of comparable properties on the market to establish a realistic rental rate for any given property. Of course, it is easy to justify in one’s mind a comparative rent that is higher than the market will bear. A house someone is in love with will almost certainly rent above market in their minds. Also when looking at similar products the rental rates may not be realistic in the marketplace. It is probably a good idea to take 5% to 10% off comparable rental rates on properties offered on the market. Once you have established what you believe to be a comparative rental rate, and you have gone through a realistic evaluation of the true costs of ownership as outlined above, a simple comparison of the two figures will tell you if a property is overvalued, undervalued or just right.

This point-in-time analysis of the relative worth of a house does leave out a couple of important financial factors: inflation and transaction costs. Inflation is the erosion of purchase power of money over time, or looked at another way, it is the increase in the price of some set of goods and services in a given economy over a period of time. It is measured as the percentage rate of change of a price index. The effect of inflation on housing costs is that it tends to increase the cost of renting over time, and theoretically, it will increase the value of a house over time as well. If the cost of rent is increasing, but your cost of ownership is fixed (assuming a fixed-rate mortgage,) then owning a home becomes less expensive over time and serves as a hedge against the impact of inflation. If you are a homeowner, inflation is your friend. There is one big cost of home ownership that works against the positive impact of inflation: transaction costs. When people buy a house, they pay some closing costs, but many of these get rolled into your loan and forgotten. When people sell a house, they generally go to a realtor to help them market the property and complete the paperwork necessary for the transaction. Real estate commissions for many years have been held at an artificially high 6% in the United States, and the seller is the one who pays this commission. From the time of purchase to the time of sale, inflation (or irrational appreciation) must have increased the value of the house enough for the sales price to cover the real estate commission or the seller will lose money. This is why it is often recommended for people who are not going to live in a given area for more than 2 or 3 years to rent instead of own. Renting is freedom — freedom to move when you wish (within the terms of your lease.)

Some people spend a great deal of effort evaluating the costs of ownership to determine if is a correct decision, but many people do not. Some people make the decision to purchase the most expensive asset they will ever own with no analysis at all. The decision to buy a house is primarily an emotional one. Even those who go through all the analysis generally only do so to provide rationalizations for their emotional decision. During price rallies, greed becomes a powerful emotion motivating people to fudge their financial analysis in order to justify their emotional purchase. Another factor often called the “nesting instinct” causes both men and women to want a place to call their own, particularly when there are children in the family. There is nothing wrong with deciding for emotional reasons. Most people pick a spouse this way. The real challenge is to have the emotions and the intellect working together to make a decision that is both fiscally sound and emotionally satisfying. This is easier said than done.

Sunday, February 3, 2008

The Graphics of a Sub-Prime Mortgage

Traditionally, banks have financed their mortgage lending through the

deposits they receive from their customers. This has limited the amount of

mortgage lending they could do.

In recent years, banks have moved to a new model where they sell on the

mortgages to the bond markets. This has made it much easier to fund additional

borrowing,

But it has also led to abuses as banks no longer have the incentive to

check carefully the mortgages they issue.

How it is suppose to work ...

How it can go wrong ...

Friday, February 1, 2008

Boss Hog Bail Outs!!

It’s a political year and I’ve been hearing a lot on Talk Radio regarding the “what to do about the real estate market.” Many folks think it's a stupid idea to bail out some “idiot” homebuyers who stretched their budgets beyond anyone's wildest imagination.

It’s a political year and I’ve been hearing a lot on Talk Radio regarding the “what to do about the real estate market.” Many folks think it's a stupid idea to bail out some “idiot” homebuyers who stretched their budgets beyond anyone's wildest imagination.The Federal Reserve has taken bold economic resuscitation steps these past weeks –- an emergency rate cut of 0.75% and another 0.5%. These are the boldest move by our central bank since 2001 or 1989, depending on how you count.

In theory, I'm all for the enforcing the harsh marketplace lesson: Bet makers must pay the price when the gamble goes belly-up. Small fry or Boss Hogs.

The fat cats too frequently get rescued, whether through direct financial boosts or by the back-channel winks and nods.

If you've got no problem with low-key negotiations stabilizing skittish financial markets, then what about that family that made a huge (but likely honest) mistake with a home loan?

Please don't tell me about what amounts to toothless federal mortgage aid plans in the works.

Plus, if you're got a significant nest egg in stocks, don't cry about borrower bailouts either. Just imagine the extra damage your net worth would have suffered if the Fed hadn't fired the heavy artillery.

Plus, if you're got a significant nest egg in stocks, don't cry about borrower bailouts either. Just imagine the extra damage your net worth would have suffered if the Fed hadn't fired the heavy artillery.Overstating Foreclosure Woes

In 2007, RealtyTrac found 2,203,295 “foreclosure filings” but that legal bureaucracy happened on just 1,285,873 residences. That’s a 71% variance!

Look, I’m not saying there’s no foreclosure problem, I’m just saying that a nation with 1.2 million families in financial trouble is ugly enough. That’s 1.03% of all U.S. households. Who cares how many legal pieces of paper they’ve received! For Virginia, the overstatement equals 24,199 foreclosure filings on 16,307 properties — a 48% variance!

To spin the good news, Virginia ranked 24th on the foreclosure rate ranking. However, Virginia foreclosure filings were up 17.3 percent from the third quarter to the fourth quarter with a 53.4 percent spike in December. To read the release, CLICK HERE

Thursday, January 31, 2008

To build a prosperous future, we must trust people with their own money and empower them to grow our economy. As we meet tonight, our economy is undergoing a period of uncertainty. America has added jobs for a record 52 straight months, but jobs are now growing at a slower pace. Wages are up, but so are prices for food and gas. Exports are rising, but the housing market has declined. And at kitchen tables across our country, there is concern about our economic future.

… and …

On housing, we must trust Americans with the responsibility of homeownership and empower them to weather turbulent times in the housing market. My administration brought together the HOPE NOW alliance, which is helping many struggling homeowners avoid foreclosure. The Congress can help even more. Tonight I ask you to pass legislation to reform Fannie Mae and Freddie Mac, modernize the Federal Housing Administration, and allow state housing agencies to issue tax-free bonds to help homeowners refinance their mortgages. These are difficult times for many American families, and by taking these steps, we can help more of them keep their homes.

No More Builder Incentives?

Read this snippet from a transcript of builder Centex’s recent conference call with Wall Street analysts (Thank you, Seeking Alpha!) …

Alex Barron - Agency Trading: Hey, guys. Wanted to ask you questions on this transparent pricing strategy. I guess, I am just trying to understand it seems to be obviously working and it seems pretty logical so I am trying to figure out why do you suppose other builders aren’t copying what you are doing and if they did what would you do compared to that or relative to that?

Timothy Eller - Chairman and Chief Executive Officer: Well I don’t know the answer to that. I would speculate that from standpoint of some private builders they may just not have the ability to do that. And based on the further question, what we are seeing is increasingly more and more of the public builders doing… doing just that because it’s it really is the reality of where the mortgage markets are today.

Cathy R. Smith - Executive Vice President and Chief Financial Officer: And then that’s a good thing we compete on community locations in our product. And that’s a good thing for us.

Alex Barron - Agency Trading: But, basically what your saying is rather than, let’s say, as an example instead of selling at $250,000 home with $50,000 incentive, all you doing is doing that your are selling it for $200,000. Is that basically the idea?

Timothy Eller - Chairman and Chief Executive Officer: That’s the idea. That’s basically… that… it’s back, its back to the way it used to be.

Centex is a nationwide builder currently selling homes in Orange (pictured at right.) To read the rest of the transcript, CLICK HERE

Wednesday, January 30, 2008

Fed cuts half point

The Federal Reserve cut its key interest rate another half-point, to 3%, as part of a continued effort to keep the U.S. economy from falling into a recession.Here’s the Fed’s thoughts on housing …

Moreover, recent information indicates a deepening of the housing contraction as well as some softening in labor markets.

To read the entire Fed statement, CLICK HERE!

Pimco Fed watcher Paul McCulley says … “The right stuff — half percent, with a balance of risks statement skewed to concerns about growth, leaving the door open for more. ben is honoring the covanent he made with the markets on Jan 10: You become more risk seeking and I will back you. Yea verily, he has.”

Thursday, January 24, 2008

Stimulus may boost lending

The current limit is $362,000 for Federal Housing Administration loans and $417,000 for loans sold to Fannie Mae and Freddie Mac. Interest rates are lower for “conforming” loans, and “jumbo” loans exceeding those amounts have become much harder to get since the credit crunch hit last summer.

Meanwhile, the Mortgage Bankers Association reports today on a mini-refinancing boom nationally. Refi applications are up 92% since November, the group said, and up 16.9% last week from the week before. Refi applications made up 66% of all apps last week. And average rates for 30-year loans, conforming of course, dropped to 5.49% from 5.62% a week earlier.

Monday, January 21, 2008

Holy Trinity Church to Open Doors in February

Arlington Bishop Paul S. Loverde will dedicate Holy Trinity Catholic Church in Gainesville, Virginia:

Arlington Bishop Paul S. Loverde will dedicate Holy Trinity Catholic Church in Gainesville, Virginia:11 a.m., Saturday February 2, 2008

Holy Trinity Church 8214 Linton Hall Road, Gainesville, VA 20155

“The dedication of the newly-completed Church of the Holy Trinity in Gainesville is not only a blessing for this parish family, but also for our entire diocesan Church. I pray that present and future members of this Parish of the Holy Trinity will experience within these sacred walls the living presence of Jesus Christ, who will unite them in giving praise to God our Father in the power of the Holy Spirit and strengthen them for their witness to truth and to charity in the world,” said Bishop Loverde. (Catholic Herald)

Construction began in February 2006 and was funded by the parish’s Founding Families capital campaign and the Rooted in Faith-Forward in Hope diocesan capital campaign. Photos of the church are available at http://www.holytrinityparish.net/

“We are very excited to finally have a home in Prince William County and we are looking forward to being in our spiritual home; to worship God as a parish and be able to provide the sacraments. Holy Trinity Church is a beautiful setting to glorify God and the Blessed Trinity,” said Father Francis J. Peffley, Pastor of Holy Trinity.

The church’s Irish gothic-style pillars and arches, paired in threes, symbolize the Holy Trinity. A focal point for the 80,000 square foot Church is the main stained glass window, which has three rings made out of pre-cast concrete, weighing over 12 tons. The cost for the church, with furnishings, will total approximately $18 million.

Father Peffley celebrated the parish’s first Mass on July 21, 2001 at the Benedictine Monastery in Bristow, Virginia. Since the parish was established in 2001, Holy Trinity Church has grown from 200 parishioners in 2001 to 5,390 parishioners in 2007. To date, Mass for Holy Trinity parishioners has been celebrated at the Benedictine Monastery, Brentsville District High School, and at other area parishes.

Over 400,000 registered Catholics belong to the 68 parishes of the Arlington Diocese, which has opened six new parishes, three new schools, and established three new missions since 1999. Further information can be found at http://www.arlingtondiocese.org/.

Friday, January 18, 2008

What's Your Risk?

1. Riverside-San Bernardino-Ontario, CA – 94%

2. Las Vegas-Paradise, NV – 89%

3. Phoenix-Mesa-Scottdale, AZ – 83%

4. Santa Ana-Anaheim-Irvine, CA – 81%

5. Los Angeles-Long Beach-Glendale, CA – 79%

6. Fort Lauderdale-Pompano Beach-Deerfield Beach, FL – 78%

7. Orlando-Kissimmee, FL – 74%

8. Sacramento-Arden-Arcade-Roseville, CA – 73%

9. Tampa-St. Petersburg-Clearwater, FL – 72%

10. West Palm Beach-Boca Raton-Boynton Beach, FL – 71%

11. San Diego-Carlsbad-San Marcos, CA – 69%

12. Oakland-Fremont-Hayward, CA – 65%

… 17. Washington-Arlington-Alexandria, DC-VA-MD-WV – 37%

PMI says: “Are we nearing the end of the current housing downturn? We don’t think so, given the magnitude of the run up in housing (with no significant housing downturn since the recession of 1991–92). That doesn’t mean that the level of housing activity has to fall to 1992 levels—after all there are almost 22 million more households today than there were back then, with higher income levels and lower unemployment rates. But the unsustainable surge of 2002–05 has to be worked off, and that’s what’s going on in the housing market today. The famous economist Herb Stein once noted, ‘If something cannot go on forever, it will stop.’ That is probably the best way to view the housing market today. We know that given the combination of demographics, job and income growth, and the level of interest rates, housing demand can’t fall without bounds.”

To read more, CLICK HERE

Tuesday, January 15, 2008

Dont't Hold Your Breathe

In fact, he thinks that even if the Fed slashes rates it would do little to help the market. Here’s his reasoning:

“Let’s say that the Federal Reserve lowers the Federal Funds rate to 2%, does this mean that we are going to start buying homes and U.S. automobiles again? The reason why nobody is willing to buy a home today is not that interest rates are too high; the reason is that home prices are too high. Nobody will want to buy a home today when they know that if they wait they could get the home for a large discount.

“This means that it does not matter what the interest rate is on mortgages; nobody is buying. And thus, it does not matter what the Federal Reserve does with the Federal Funds rate. And I actually believe the Federal Reserve knows this. They are well aware of the ineffectiveness of the Federal Funds rate to help bring back the U.S. housing market and/or the U.S. auto sector. Thus, I still believe that many of the Federal Reserve Governors are going to be reluctant to lower the Federal Funds rate even if they ultimately go ahead with a decrease in the rate on January 30th.”

Aleman argues that the bigger concern for the Fed right now is inflation.

CLICK HERE for full report.

Friday, January 11, 2008

The End of the Buyer's Market!!!!

Seller’s Market = Sellers dictate price and terms (Woe to Buyer)

Why would banks continue to loan 90% of value when there is a likelihood of a greater than 10% decline and banks know high loan-to-value ratios result in high default rates? They are doing it now because they have to in order to make any loans at all. But only the very high FICO scores will qualify, and they are betting these people will not default do to moral reasons or the desire to keep that high FICO score. If they try to extend these loans to lower FICO score individuals or subprime borrowers, they won’t stay in business long. Large downpayments are coming back, and government assisted financing will become widely used by first-time homebuyers to overcome the high equity requirements. What other way is there to move forward?

Zillow improves math, 97% of Washington Metro now covered

Zillow indicates the Washington Metro data now has 97% of the homes with Zestimates, 41% are within 5% of the selling price, 65% are within 10% of the selling price, and 84% are within 20% of the selling price.

Prince William data has 87% of the homes with Zestimates, 43% are within 5% of the selling price, 68% are within 10% of the selling price, and 90% are within 20% of the selling price.

By the way, Zillow puts typical Prince William home values down 9.0% in a year.

Why not try Zillow out and report back what you find about the homes you know best and the Web site’s “new math” …

Thursday, January 10, 2008

58.5% of Moving Vans Arriving in D.C.

United says it had 1,116 (58.5%) inbound moves to DC last year vs. 793 (41.5%) of their business. DC has remained inbound since the inception of the study (1977).

I-66/Route 29/Linton Hall Rd Interchange

-------------------------------

What's being done

Route 29/Linton Hall Interchange Improvement Project is one of the largest construction projects in Virginia. The current total estimated project cost is approximately $181.4M.

The purpose of the Phase IV - I-66/Route 29/Linton Hall Road Interchange project is to construct a grade separated interchange at the existing Route 29/Linton Hall Road intersection, creating a fully limited access facility on Route 29 between Virginia Oaks Drive and Heatcote Boulevard. The interchange will be a single point urban diamond interchange (SPUI), with a braided ramp configuration along southbound Route 29 between I-66, Linton Hall Road and Gallerher Road.

The interchange will include 4 bridges:B632 - Route 29 and Ramp K over Norfolk Southern Railroad

B633 - Linton Hall Road over Route 29

B634 - Route 55 over Norfolk Southern Railroad, and

B635 - Ramp G over Ramp K.

Also associated with this project are the removal of at-grade railroad crossings (Norfolk Southern Railroad at Gallerher Road, Route 29 northbound and southbound) and two traffic signals along Route 29. Following completion, Route 29 will be a 6-lane divided facility between I-66 and Virginia Oaks Drive and will operate without signals or obstructions within this same area.

Phase IV Plan Roll in PDF Format

Features

Proposed Construction Phasing - Maintenance of Traffic

There are three main phases of construction - Phase 1 is broken into two parts that can be completed mostly at the same time.

Below is the preliminary breakdown of various construction phases with a rough estimated construction cost at this time:

Phase 1A - Detour Construction - $10 million - includes Route 29 & Linton Hall detour construction and temporary railroad signal crossings. Estimate construction time for this phase is 6 months.

Phase 1B - Interchange Construction - $50 million - includes Linton Hall Road bridges over 29 and NS Railroad NB 29 Bridge over NS Railroad ultimate grades of NB 29 and portions of interchange ramps, and access roads. Estimate construction time for this phase is 24 months.

Phase 2 - Interchange Construction - $30 million - includes SB 29 bridge over NS Railroad Ramp G bridge over Ramp K ultimate SB 29 grading and portions of braided ramps. Estimate construction time for this phase is 12 months.

Phase 3 - Interchange Construction - $5 million - includes final portions of Ramps I and J and minor detours to facilitate final construction. Estimated construction time for this phase is 6 months.

Estimated Total Construction Time: 4 Years

What's being done

Summary of other I-66 Projects

Phase I (UPC 63724) - University Boulevard - new alignment Construct a four-lane divided roadway with a bridge over I-66 from Wellington Road to Rte 29.

Status: Construction completed and opened to traffic on August 06.

Phase II (UPC 69113) - I-66 HOV widening from Rte 234 Business to the Rte 234 Bypass. Add one HOV and one SOV lane to EB and WB converting the existing four lane divided interstate to eight lanes divided.

Status: Construction completed and opened to traffic in November 2006.

Phase III (UPC 70043) - I-66 HOV widening from Rte Bypass to Rte 29. Add one HOV and one SOV lane to EB and WB converting the existing four lane divided interstate to eight lanes divided.

Status: Construction started on December 2006 with a completion date of August 2010.

Traffic Data

Based on traffic counts, Route 29 carried 46000 vehicles per day (ADT - average daily traffic) in 2005, and is anticipated to increase to 63,000 ADT by 2035. Linton Hall Road's count in 1998 was at 9000 ADT, and by 2005 that number had increased to 15,500 ADT. By 2035 it is anticipated to grow to 42,000 ADT on Linton Hall Road.

Thursday, January 3, 2008

Meet Your Refinance Savior

In a market when appraisal values make it hard to refinance, one option is still available.

Normally to refinance, you must qualify by providing all of your income, banking, credit, and liability information as well as an appraisal. With a FHA streamline refinance a property appraisal is not required. However, the new loan amount cannot exceed the original loan amount. The FHA streamline mortgage programs are great if you like little paperwork and no hassles.

FHA Streamline finances can also be used to shorten a 30 Year Loan to a 15 year as well as to take one out of an FHA adjustable rate mortgage. The main qualification standard is a timely mortgage payment history.

The basic requirements of an FHA streamline refinance are that your present mortgage must already be FHA insured, your mortgage should be current (you can now finance the payment due for the first of the month you close), the loan should result in a lowering of your principal and interest payments, and no cash may be taken out.

FHA Streamline refinances generally do not require an additional appraisal to complete, which alone saves the borrower hundreds of dollars in fees and potentially thousands of dollars in interest due to the faster close, and the fact that you don't have to finance the cost of an appraisal over 30 years.

FHA Streamline Refinance is a mortgage that can reduce one's rate. It can reduce the amount of documentation and the need for an appraisal and credit check to speed the processing of the loan.

Wednesday, January 2, 2008

Manassas - 2007 Market Trend Analysis

Average Original List Price: $347,754

Average Sales Price: $316,726 (91.1% of Original Price)

Average Days on Market: 128

Average Homes Sold per Month: 95

Total Sold in 2007: 1135

Currently Active Listings:

Average List Price: $292,775

Average Days on Market: 132

Total Listed: 1537

As we enter the new year, it is important to know the path the market is currently on. Sellers need to lead the market not follow. Continually lagging behind the trend will lead to higher days on the market and lower "walkaway" sales prices.

Haymarket - 2007 Market Trend Analysis

Average Original List Price: $590,499

Average Sales Price: $549,690 (93.1% of Original Price)

Average Days on Market: 133

Average Homes Sold per Month: 27

Total Sold in 2007: 320

Currently Active Listings:

Average List Price: $608,055

Average Days on Market: 254

Total Listed: 290

As we enter the new year, it is important to know the path the market is currently on. Sellers need to lead the market not follow. Continually lagging behind the trend will lead to higher days on the market and lower "walkaway" sales prices.

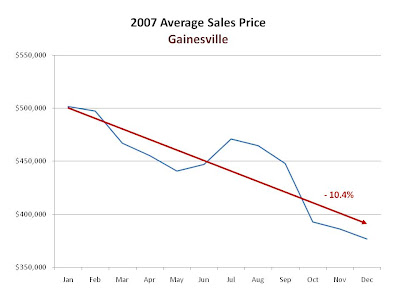

Gainesville - 2007 Market Trend Analysis

Average Original List Price: $483,484

Average Sales Price: $449,521 (93.0% of Original Price)

Average Days on Market: 118

Average Homes Sold per Month: 42

Total Sold in 2007: 502

Currently Active Listings:

Average List Price: $476,627

Average Days on Market: 154

Total Listed: 389

As we enter the new year, it is important to know the path the market is currently on. Sellers need to lead the market not follow. Continually lagging behind the trend will lead to higher days on the market and lower "walkaway" sales prices.

Tuesday, January 1, 2008

FHA 203K Streamline - Rehab Loan

Need 1 bid for work to be completed from a licensed contractor.

We do one appraisal with 2 values - as is and subject to completion. Completed value must be supported.

Two draws - 1. at closing for materials - cannot exceed 50% of the estimated cost

2. Labor when done

6 months to complete the work

Borrower needs 3% of sales price - can use Nehemiah grant program.

Rate is about .25% higher when doing 203K

Work to be performed must not cause the mortgagor to be displaced from the property for more than 30 days during the time of the rehabilitation work is being conducted.

Cannot increase living space like finishing basement or putting on an addition.

The following repairs can be financed with this program::

- Repair/Replacement of roofs, gutters and downspouts

- Repair/Replacement/upgrade of existing HVAC systems

- Repair/Replacement/upgrade of plumbing and electrical systems

Repair/Replacement of existing flooring - Minor remodeling, such as kitchens, which does not involve structural repairs

- Exterior and interior painting

- Weatherization: including storm windows and doors, insulation weather stripping, etc.

- Purchase and installation of appliances, including free-standing ranges, refrigerators, washers/dryers, dishwashers and microwaves.

- Improvements for accessibility for persons with disabilities.

- Lead based paint stabilization or abatement of lead based paint hazards.

- Repair, replacement or the addition of exterior decks, patios and porches.

- Basement remodeling which does not involve sculptural repairs.

- Basement waterproofing.

- Window and door replacement and exterior siding replacement.

- Well or septic system repair or replacement

Just some usefully information from your friendly neighborhood Realtor

2007 Top Ten List

According to the Potomac News & Manassas Journal Messenger the top 10 news stories of 2007 for Prince William County were:

- Illegal Immigration Debate

- Transportation Issues

- Three People Killed (Triple Homicide)

- The War

- County Continues to Grow

- The Crash of the Real Estate Market

- Virginia Tech Shootings

- Antibiotic-Resistant Staph Infections

- Political Arena Faces Shake-up

- Residents' Unusual Stories

Personnally, I think the market should be ranked higher. It's ecomonic impact will be felt in 2008. Good luck to all in 2008.

.jpg)

.jpg)

.jpg)